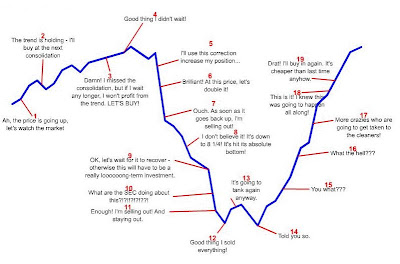

What does it take for a country's stock market to rise 6% in a day? What kind of news can jump start that? Apparently, very little. China Mobile announced that it will buy a 12% stake in Far East Tone Telecommunications. The news raised hopes that there is a tacit approval from Beijing to encourage China firms to do more investments into Taiwan.

Besides being a good move politically, its a very good move economically as well. Just look at how Hong Kong's economy rely on China, its like a modern day umbilical cord. At the same time, it leverages on the advantages of each side to link up. A similar situation looks to be happening between China and Taiwan. Can you imagine the economic might of a Greater China economic grouping that has HK, China and Taiwan. Its pretty formidable. Its might and collective strength more than equates an ASEAN grouping.

Far East Tone is Taiwan's third largest telco. The deal still needs approval from Taiwan regulators, but it should be a done deal. If approved, it would be the first direct investment from China. This comes after another ground breaking development when China agreed to let Taiwan to send observers to the annual meeting of the World Health Assembly, the WHO's ruling body, next month in Geneva. Ties have improved significantly under Taiwan's President Ma Ying Jeou. The two sides have signed a series of agreements easing limits on investments between the two and establish the first regular two way air and shipping traffic.

President Ma Ying-jeou said that the 1952 Treaty of Taipei affirmed the transfer of Taiwan's sovereignty from Japan to the Republic of China. Ma's statement deviated from his previous claim that it was the 1943 Cairo Declaration that gave the ROC its claim to Taiwan. "While the 1952 treaty does not specify the legal successor government [of Taiwan], it was clear between the lines," he said. "Japan would not have signed the accord with the ROC if it did not intend to concede the territories to the ROC."

Ma said the 1952 pact had three meanings: It not only affirmed the "de jure termination of war between Japan and the ROC" after Tokyo's surrender in 1945, but reasserted the "de jure transfer of Taiwan's sovereignty to the ROC" as well as "restoring friendly and normal relations with Japan. Read this any way you like, its not the China Mobile story that pushed Taiex higher, its this statement by Ma.

There are many ways to court a girl. You can threaten, scream, shout and warn ... but those will never be as effective as cajole, serenade, being generous, showing respect and tenderness. China heart Taiwan.

p/s photos: JJ

![[stress tested]](http://s.wsj.net/public/resources/images/MI-AW368B_BANKS_NS_20090424204819.gif)