The markets have been wrought with worries about a few EU countries and the Euro currency which have rattled global equity markets. Sovereign debt credit default swaps have been rising sharply for countries such as Greece and Portugal in recent days. Equity markets in Spain, Portugal, and Hungary are down more than 5% today alone.

The markets have been wrought with worries about a few EU countries and the Euro currency which have rattled global equity markets. Sovereign debt credit default swaps have been rising sharply for countries such as Greece and Portugal in recent days. Equity markets in Spain, Portugal, and Hungary are down more than 5% today alone. Below Bespoke highlighted the year to date performance and performance since the 19 January 2010 peak for the major equity markets of 81 countries around the world.

Spain is down the most year to date with a decline of 13.45%. Greece is second worse with a decline of 11.13%, followed by Puerto Rico, Jamaica, Slovakia, and China. Italy, Germany, and France are down more than 5% year to date, while the UK is down 4.87%. The US is down 3.58%, but it has been the second best performing G-7 country year to date behind Japan. Thirty-eight of the 81 countries are still up year to date, so things haven't gotten that bad everywhere. Latvia, Lithuania, and Estonia are all up more than 20%.

What's interesting is to see where Malaysia is, we are right at the median. One can safely say that our correlation to major equity markets have been very mild - in other words we are still not a preferred destination for foreign funds. Can be good or bad, you do not see much whiplash action when these funds withdraw. Even though our KLCI index has tumbled, its mainly due to weakness in the big caps, if you had been in mid or small caps, your losses would have been muted.

Indonesia and Vietnam have held up even better as I did see some foreign funds preferring to have an exposure there. Usually in this type of correction, where macro factors and sovereign debt are involved, foreign funds in smaller emerging markets are quite OK to stay put. If they feared funds withdrawals, it is easier to get money out of HK, Taiwan and Brazil.

Some funds have certainly taken chips off the table, however I do not see this as a prolonged bear market at all. Where else will they put money to work? Treasuries?

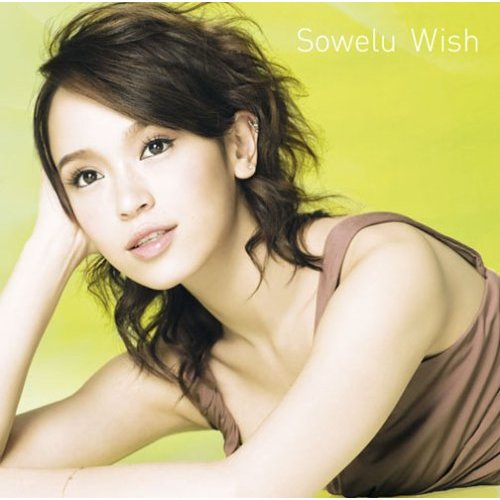

p/s photos: Sowelu

p/s photos: Sowelu

No comments:

Post a Comment