This was easily one of the better written articles on the markets that I have read for the past couple of weeks. Its by Andrew Butter, and he basically argued that there would be no correction until the Dow reaches 10,000. Its pretty much in line with my views that I have.

Andrew Butter: At Davos, Professor Nouriel Roubini declared that US banks were insolvent. On 14th March he declared that the incipient US stock market rally was a "dead-cat-bounce-..." that would be overturned by the terrible economic prospects.

Last time I looked, the Dow was up almost 30% on 9th March, which puts it well out of normal dead-cat-bounce territory.

And "Hallelujah", the Stress Tests have confirmed "beyond any reasonable doubt" that Secretary Paulson was absolutely correct when he announced to an adoring public in July 2008 that "the US banking system is safe and sound".

Well actually, as Lord Cooper's aide used to say in Evelyn Waugh's classic "Scoop", "Up to a point!"

The "doomsayers", (and there are many) point to (a) P/E ratios (going down to 4,000) (b) the lousy economic prospects, (c) insider selling, (d) the still stinking banking system, (e) creative accounting, and... (Phew!)...(f) corruption and crass incompetence in high places, (and they say this HAS to have an unhappy ending).

I don't have an argument with most of that, except perhaps the "answer"; I'm not so sure that there will be an unhappy ending...haven't we had enough of those for one crash?

Perhaps there is a limit to how much damage you can do to an economy, even if you try real hard - look at Somalia, a failed state. But the Wall Street Bankers can only sit in silent admiration and marvel at how creative young entrepreneurs have figured out bold new ways to rip people off (of course that's just a cottage industry compared to Wall Street - what they need is some organization and a few lobbyists and then do an IPO).

Anyway, as it floated higher the rally got incrementally downgraded to a "sucker" then a "bear" then what...a "chump"?

Now there is apparently a legion of investors scratching their heads and holding their breath, waiting in strained anticipation for the next thing they don't understand to bite them in the backside.

But Professor Roubini is always right...RIGHT!

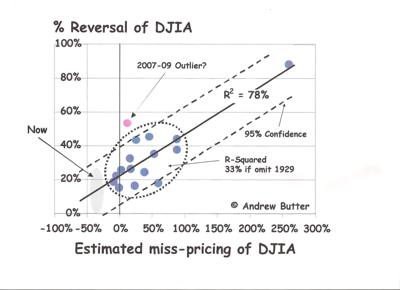

Well, up to a point. This chart compares the size of reversals over 15% for the DJIA since 1929 with the extent of mis-pricing (mis-pricing is explained here).

click to enlarge

So for that limited amount of data the extent of mis-pricing appears to be a reasonable predictor of the size of the reversal (I treated the recent reversal as part of the Dot.com reversal, i.e. as an outlier - I don't regard deliberately shooting yourself in the foot as a typical "market" phenomena).

However if the 88% reversal from 1929 to the eventual bottom three years later is taken out there is not a good predictor relationship (33% R-Squared is about random; although there is a range - only 5% chance of being outside the dotted line).

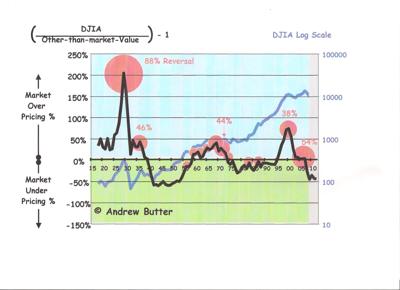

Anyway, market-long-wave analysis says that for DJIA breaking 10,000 in 2009 it will be 37% to 42% mis-priced (below); and that's for worst case nominal economic growth of minus 4% in 2009 and let's say worst case the 10 Year Note goes up to 4.5% from now (as the men in suits with their hands deep in the US taxpayers pockets try and raise more trillions - I won't discuss what they are holding in those hands).

And the downswing predicted from the previous upswing is 42%, so that looks about the bottom in mis-pricing on the downside to me.

Looking at the chart, it appears there has never been a major reversal of the DJIA (i.e. greater than 15%) when the mis-pricing was more than 10% (under), so regardless of the impeccable logic for why this was a sucker-dead-cat, I just don't see a reversal coming any time soon.

Looking at that another way, the extent of reversal compared to the history with the diameter of the rings sized to represent the extent of reversal:

This chart illustrates that reversals typically seem to happen when the market is mis-priced above the estimated "other-than-market", which intuitively makes a lot of sense.

Also, the size of the reversal appears to be broadly proportional to the speed at which the market went out of equilibrium and over 45 years when the market was mis-priced under.

Only three reversals happened when mis-pricing was negative and in each case the line was moving up towards zero, minimum was 10% mis-priced. That compares to twelve major reversals in the 45 years it was mis-priced over.

So right now, if indeed the Dow is about 40% mis-priced under, for it to be 10% mis-priced it will have to reach 14,000 this year which would be a bit of a stretch (history suggests it's going to bumble along in the range -30% to -45% for the next year at least).

So where does this leave the sucker-dead-cat-bounce rally, downgraded to a chump-rally?

My view from looking at that data, and assuming that the bankers are not going to manage to screw things up in 2009 as badly as they did in 2003 to 2007 (i.e. "no more surprises or super con tricks this rip-off-and-run season"), then it's highly unlikely that there will be a significant (more than 15%) reversal in the DJIA (and the S&P 500 correlates with that), certainly not worth breaking into a sweat over until the DJIA goes through 10,000.

If there is, well, I'll ring the neck of this darn cat that's been sitting on my lap since early March and barbeque it.

p/s photo: Zhou Wei Tong

No comments:

Post a Comment