This announcement is dated 6 January 2010.

Announcement Details :

Table 1 | |||||

| Name of Director | Name of Registered Holder | Date of Acquisition | Purchase Price per share | Number of Ordinary Shares of RM0.50 each acquired | % of Issued Shares# |

| Thoo Chow Fah | Choo Wai Sook | 6 January 2010 | RM2.75 | 100,000* | 0.07* |

Comment: A director buying at RM2.75. Its not a significant size, but the timing is significant.

| Type | : | Announcement | |

| Subject | : |

| |

| Contents | : |

| |

| | |||

Finally, supposed to be in December, about one month late. Its whom will be taking up the placement which will be important, not the price. Please read posting on Notion Vtec back in October:

http://malaysiafinance.blogspot.com/2009/10/why-i-like-notion-vtec-tons-of.html

| Type | : | Announcement | |

| Subject | : |

| |

| Contents | : |

| |

Comment: Very interesting announcement during the share split and ex period for bonus and free warrants. How significant is the acquisition. Well, industry insiders will tell you that there were a lot of bidders for SMCH, and for KPJ to even get 51% is nothing short of a coup. 51% for RM51m, have you tried building a hospital now for less than RM150m??? ... thats why its a coup.

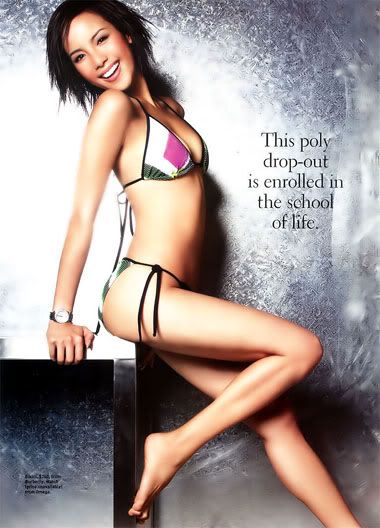

p/s photos: Fiona Xie

No comments:

Post a Comment