The 3 factors all helped to move funds into equity because its pointless to stay sidelined in a near zero interest rate environment. Funds seeking safe havens in the yen and other selected currencies such as Swiss franc have finally turned the other way as they do not see a need for that anymore. Now you have the carry trade going into high gear again - previously the carry trade was in yen based on the near zero interest rate, now the carry trade is also in yen but on the platform that you will be probably be paying back in a weaker yen 6 to 12 month down the road.

US Funds Flow Into Equity

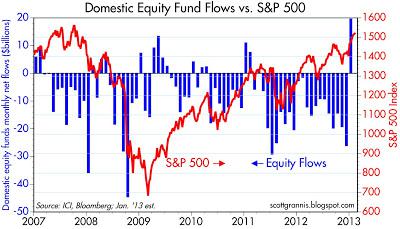

Domestic equity funds experienced their largest monthly inflow in the past six years, according to preliminary figures tallied by the Investment Company Institute (see first chart). This follows six years during which equity funds experienced huge and almost relentless outflows.

Has the tide finally turned? Are investors now finally becoming bullish after four years of strong equity gains? Perhaps, but if this is the beginning of the return of bullish sentiment, it likely has a long way to go before it runs out of gas.

VIX which measures market risk is in a very stable low risk zone.

Commercial Property Recovery

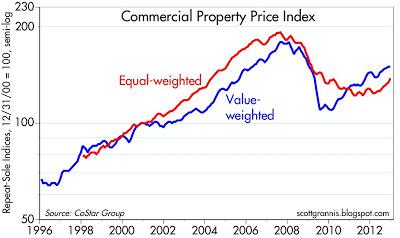

The recovery in commercial real estate is now almost four years old. As the first chart shows, commercial property prices are up decisively in recent years. As reported by Costar, its Value Weighted Index was the first to turn up due to strength in the high-end sector of property market. But now the equal weighted index is starting to catch up, a sign that the recovery is broadening.

The second chart shows the price action for Vanguard's REIT fund, whose price has risen 215% from its March 2009 low. On a total return basis, this fund has trounced the S&P 500, gaining 287% vs. 142% since the March 2009 lows.

Thanks to panic-induced selling in late 2008 and early 2009, commercial real estate and related prices reached incredibly depressed lows. This represented one of the buying opportunities of a lifetime. If the economy merely avoids another recession, commercial real estate is likely to continue to deliver attractive returns relative to the almost-zero yield on cash.

No comments:

Post a Comment