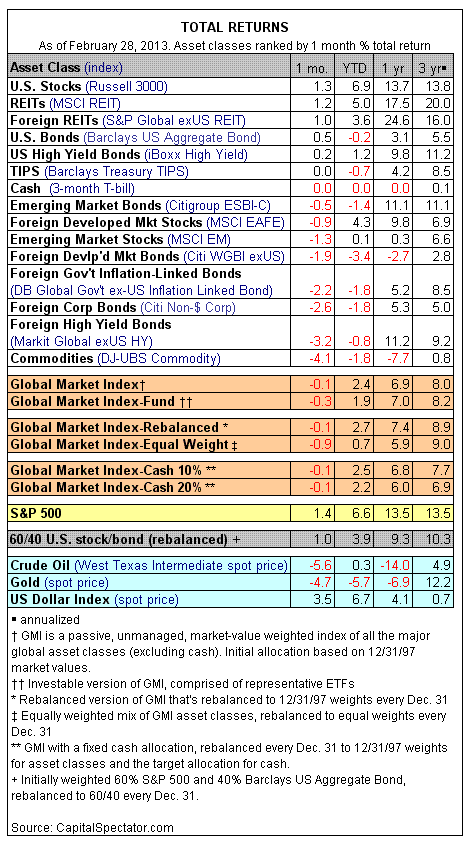

The big loser last month was commodities, which shed more than 4% overall. Meanwhile, REITs continue to rise, adding 1.2% in the U.S. market and gaining 1.0% on an offshore basis. Over the past year, REITs generally are in the performance lead among the major asset classes. Foreign REITs in particular are higher by a strong 24.6% through the end of February 2013. REITs has been on a tear for most of the past 12 months, a strong indication of the recovery in commercial properties - the fact that money is leaving the sidelines and venturing into stocks and properties in the US is a strong trend for a buoyant market in 2013.

By comparison, bonds, US and foreign have been muted, again a show of money exiting bonds. You would think that considering a market rally in equities based on liquidity (thanks to all central banks printing press) would have seen an effect in commodities, the reverse is happening. That is not a good thing as it may mean that the current equity rally is largely a bubble as it is not translating into real activity (i.e. pickup in commodities buying for end products or consumption). A better explanation would that there has been so much excess capacity and inventory for commodities that they will only pick up by June July methinks, same for the precious oil.

No comments:

Post a Comment